Updated at 19/07/2022 - 05:15 pm

Changes to Labor Contract #

1. Increase the identity of the labor relationship

- Any contract with all 3 following signs will be considered as labor contract (According to Clause 1 Article 3)

+ Work on the basis of agreement

+ Pay salary

+ There is the management, administration and supervision of one party

2. To enter into a labor contract via electronic means (this labor contract has the same validity as a written labor contract) – According to Clause 1, Article 4

3. No more seasonal contracts of less than 1 month or a certain job (Clause 1, Article 20)

- Only 02 types of labor contracts remain

+ Labor contract with indefinite term

+ Definite term labor contract not exceeding 36 months

4. The parties can choose flexible probation

- The probationary content can be written in a labor contract or a separate probationary contract. During the probationary period, each party has the right to cancel the probationary contract or the signed labor contract without prior notice and compensation.

- Adding a provision that the probation period does not exceed 180 days for the jobs of enterprise managers according to the Law on Enterprises, the Law on Management and Use of State Capital to invest in production and business in enterprises.

5. Employers have the right to sign multiple definite-term labor contracts with elderly employees and foreign workers in Vietnam (Article 36).

6. The employee has the full right to unilaterally terminate the labor contract without reason, but must notify the employer in advance according to the prescribed time limit (Clause 1, Article 35).

- Contract with indefinite term: ≥ 45 days.

- Definite term contracts with a term of 12 to 36 months: ≥ 30 days.

- Definite term contracts with a term of less than 12 months: ≥ 03 working days.

- Some specific industries and jobs: The Government will specify.

7. Specifying clearly 07 cases in which the employee has the right to terminate the labor contract without prior notice, unless otherwise agreed by the parties (Article 35).

8. Reasonable provisions on the settlement time and responsibilities of the two parties when terminating the labor contract

- Increasing the time from 7 days to 14 working days for both the employee and the employer to fully pay the amounts related to benefits of each party; special cases remain the same for up to 30 days.

- Provisions on supplementing the employer's responsibility to complete the procedures for confirming the employee's social insurance payment time, providing copies of documents related to the employee's working history if the employee requests and pays all costs of copying document.

Changes in Salary #

1. Salary scale, labor norms:

- No need to register ladder, payroll to state agencies

- Enterprises are autonomous in building wage scales, payrolls and labor norms based on discussions with the representative organizations of employees at the enterprise and publicize at the workplace before implementation (Article 93)

2. The employer must notify the employee's salary statement, clearly stating the salary for overtime, working at night, the content and the amount deducted (if any).

3. When paying salary via bank, the employer must pay the account opening fee (Clause 2, Article 94).

4. It is forbidden to force employees to have enough salary to buy goods and services of the company

5. Employees can be rewarded not only with money (can be assets, goods or other forms)

6. The employee can authorize another person to receive the salary deemed reasonable, especially in case the employee is sick or has an accident and cannot directly receive the salary...

Changes in Social Insurance #

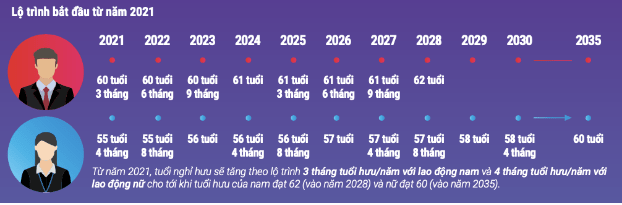

1. Change of conditions for pension entitlement

- For people participating in compulsory social insurance in normal working conditions

Detailed provisions are in Article 169

2. Changes in health insurance policy

Specifically, from January 01, 01, in cases where the health insurance card holder does not go to the correct level of health care by himself / herself, the health insurance fund shall pay the benefits specified in Clause 2021, Article 1 of the Law on Health Insurance (the rate of entitlement to medical examination at the right level). the following rate:

- At central hospitals: 40% of inpatient treatment costs;

- At provincial hospitals, 100% of inpatient treatment costs from January 01, 01 nationwide (currently only 2021% of inpatient costs are paid according to the rate of the health insurance card).

- At district hospitals, it is 100% of medical care costs

See full text Labor Code 2019 No. 45/2019 / QH14